Climate Change

Engaging with external stakeholders to understand their perspectives helps inform our strategy to manage climate-related risks. We understand that market changes could result from U.S. policy, global agreements and evolving domestic and international climate change laws and regulations. At the same time, we recognize the need for reliable and responsibly produced energy and petrochemical feedstock.

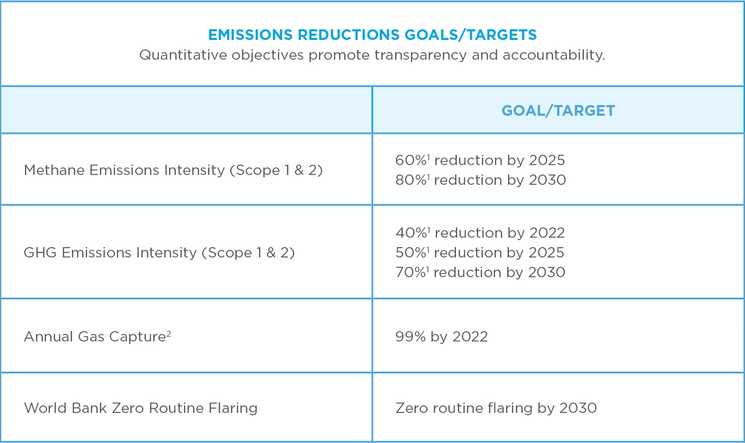

In February 2022, consistent with our objective to help successfully meet global energy demand, we set new aggressive near-term (2022), medium-term (2025) and long-term (2030) goals for critical environmental performance metrics, including our methane intensity, GHG intensity and annual gas capture (flaring intensity). These objectives are intended to drive strong environmental performance, promote external transparency and accountability and enhance internal alignment and employee innovation.

The following Climate Change subsection of our Sustainability Report is aligned with the Task Force on Climate-related Financial Disclosures (TCFD).

TCFD Pillars

Identifying and Managing Risks

Our Enterprise Risk Management (ERM) and Responsible Operations Management System (ROMS) processes are the primary internal assessment tools we use to identify and communicate climate-related risk.

Managing Our Business for Resilience

Marathon Oil’s diverse portfolio seeks to mitigate market risks.

Regulatory, Weather and Value Chain

We’re subject to numerous legal, regulatory and other requirements intended to uphold the health and safety of people and protect the environment, including those relating to natural gas flaring and greenhouse gas emissions.

How are we doing?

Your opinion matters. Please take a moment to let us know how useful you find the content on this page.

If you’d like to give us your feedback on the entire report, please fill out the complete survey for the 2022 report.